General Information

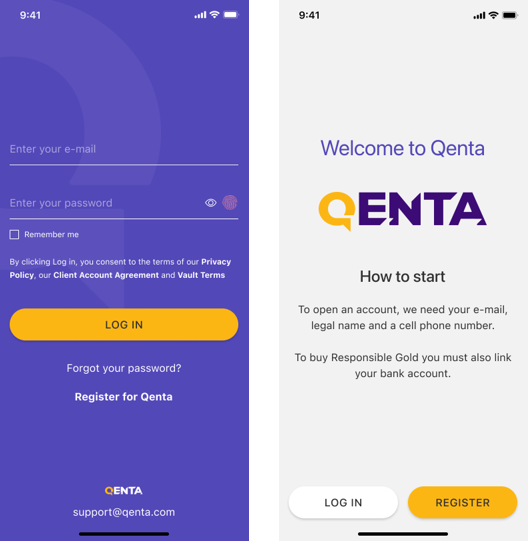

First, you need to download the Qenta app from the Apple or Google Play Stores. Then, you will be prompted to register for your Qenta account. You will need to provide your email and country/state of residence as it appears on your government issued ID.

There are a few reasons why you might consider including gold in their portfolio:

- Diversification: Gold tends to have a low or negative correlation with other asset classes, such as stocks and bonds. This means that gold can potentially help to diversify an investment portfolio and reduce the overall volatility of returns.

- Inflation hedge: Gold is sometimes seen as a hedge against inflation because it tends to retain its value over time, even when the purchasing power of paper currencies declines.

- Safe haven: During times of economic or political uncertainty, gold is sometimes viewed as a safe haven asset because it is widely recognized and accepted as a store of value.

It’s important to note that gold is not a risk-free investment and can fluctuate in value. As with any investment, it’s important to do your own research and carefully consider your investment objectives, risk tolerance, and overall financial situation before deciding whether to invest in gold. Qenta does not provide tax, investment, or legal advice or advisory services.

| Because gold prices often do not trade in the same direction as the stock market, some compare buying gold to buying insurance. You may not need it, but it may be beneficial in some circumstances. | |

| This diversification means that under normal market conditions gold prices may have low correlation to most asset classes and in times of stress, such as during “tail events” and financial crises, gold prices’ correlation may be negative. |

| Gold may protect against the wealth decay of inflation and currency devaluation. |

| There is no credit risk associated with owning physical gold. |

| The drivers behind gold supply and demand tend to be independent of, and sometimes opposed to, other traditional reserve assets (like currencies, securities, and bonds), making physical gold an effective diversifier for investment portfolios. |

Pricing

Everything you need to know about the price of gold in the Qenta App and any fees associated with your account

In the gold market, and in financial markets in general, the difference between the buy price and the sell price is known as the “bid-ask spread”. It is the amount by which the Buy Price is greater than the Sell Price. This spread is how we cover our costs and make a profit.

The responsibly sourced gold (Responsible Gold™), purchased on the Qenta App is currently not redeemable for physical gold. However, in the near future we will update the list of countries where this service becomes available.

There will be no additional cost for the redemption of a kilobar (1,000 grams) however if redemption is required in smaller denominations, then 10 gram bars will be available at a manufacturing cost of 5%. In all cases shipping charges will be at the cost of the redeemer. You will be able to request the physical redemption of your gold through the Qenta App once the service is available in your country.

You can sell your gold or cash out at any time, 24/7 via PayPal or ACH or Swift bank transfer, and Payoneer (*coming soon) at the latest or real-time market price of gold.

Legal Compliance And Corporate

Qenta Inc. is a privately held company with offices and operations on 5 continents and more than 400 employees. It offers the highest level of security and compliance and is governed by financial authorizations in Bermuda, Brazil, Dubai, Ghana, Luxembourg, Switzerland, and the US.

Qenta Inc., is headquartered in Houston, TX with offices Accra, Bangalore, Dubai, Frankfurt, Geneva, Graz, Lahore, London, Sao Paulo, Sarajevo, and Shanghai.

In the unlikely event that Qenta Inc. goes out of business, you still maintain the title of ownership to your gold. As a customer, your gold holdings are fully insulated from Qenta’s activities. G-Mint S.à.r.l., a Swiss limited company (“G-Mint”), acts as your bailee for the gold associated with your purchases on the Qenta App. In such capacity, G-Mint keeps the gold in safe deposit with one of the licensed gold storage facilities for the benefit of each gold owner. In order to ensure G-Mint’s continued financial viability, G-Mint collects storage fees directly from each Qenta wallet, which are used to cover the cost of storing and insuring your gold. Please refer to the Vault Terms for more information.

Technology

Our blockchain is based on Quorum, an advanced evolution of the Ethereum blockchain developed by J.P. Morgan.

We are developing an ecosystem of applications and services built on a permissioned blockchain distributed ledger. A blockchain distributed ledger makes the creation of immutable transaction records possible. Our blockchain is “permissioned” meaning that all participants must undergo KYC/AML processes. The technology allows for comprehensive identity and authentication management, regulatory compliance, supply chain provenance tracking, and title transfer solutions. The network has a limited number of nodes to facilitate high speed. The nodes are run by independent and highly regarded market participants and industry organizations to generate the trust of the ecosystem’s users and participants.

Payout Customers

You can hold your gold securely within the app until you decide to sell and cash out via PayPal, bank transfer, or Payoneer (*coming soon)

In order to receive your payout via or Paypal or Payoneer please just send us an email to appsupport@qenta.com confirming the email address you would like your payment sent to. Once we have verified the transaction we will initiate the payment, which you will then receive within 24 to 48 hours.

Information needed for bank transfers

The information required will depend on the type of transfer that you choose. Please refer to the below table which provides details for both ACH and SWIFT transfers:

US Customers (ACH Transfer)

1. Beneficiary Name

2. Routing/ABA number

3. Account number

4. Whether the bank account is a business or personal account

Non-US Customer (SWIFT Transfer)

1. Beneficiary Name

2. Beneficiary Address

3. Beneficiary Phone Number

4. Destination Bank Name

5. Destination Bank Address

6. Destination Bank SWIFT or BIC code

7. Account number or IBAN of the recipient

Information needed for MoneyGram payouts

For MoneyGram payouts, you would need to provide the Sender Name, Sender Country, Receiver Name, Receiver Country, DOB, address, phone number, and personal ID info.

Please note that MoneyGram payouts are currently available in the following countries: Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Spain, Sweden, Switzerland, UK, US, Canada, Australia, Hong Kong, New Zealand, and Singapore.

Read about payout currency

We will execute all payouts in USD. Please note however that these funds may be converted upon receipt by PayPal, Payoneer, MoneyGram, or your bank as determined by their policy.